Insights

Go Global in 2024 with Emerging Markets Corporate Debt

Featured

Go Global in 2024 with Emerging Markets Corporate Debt

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. Emerging markets (EM) corporate debt asset class has grown to be a source of ample investment opportunity since the launch of its main index in 2007.

2. Historically, registered defaults and recoveries for EM corporate debt are in-line with U.S. high yield, while offering investors additional yield spread.

3. The asset class offers investors geographical diversity while still retaining attractive risk adjusted returns.

Boston - In December, reviews and outlooks are discussed more than in any other time of year. While we claim no exception to this seasonal behavior, this year, we invite you to look a little further back to the evolution of our asset class and highlight inefficiencies in the space where the Morgan Stanley Investment Management's Emerging Markets Debt team feels that we were able to capitalize on and deliver postive outcomes for our clients.

The JPMorgan Corporate Emerging Markets Bond Index (CEMBI), the primary benchmark for corporate bonds in emerging markets, launched in November 2007. Just as Brady Bonds and the creation of the JPMorgan Emerging Markets Bond index (EMBI) invited more sovereign issuers to the U.S. dollar bond market, the creation of the CEMBI opened the gates to corporate issuers in emerging markets.

By December 2008, CEMBI comprised 186 issuers from 36 countries with a total market capitalization of $204 billion. Though investors had to muddle through the humbling turbulence of the Great Financial Crisis, this market continued to grow as the years went by, ushering in new dedicated investors like us (MSIM launched our first EM Corporate Debt Fund in 2011) and became what we consider a valuable asset class of its own.

In fact, on a risk-adjusted basis, the EM corporate debt has been the best performer across the three major EM debt sub-indices: Local currency sovereign debt, U.S. dollar denominated sovereign debt and corporates.1

In our estimation, global investors today are over-indexed to U.S. corporate earnings streams (via equities, fixed income, private assets, etc.). The EM corporate debt asset class offers investors a way to diversify their risk allocation away from the U.S., while still retaining high levels of income and capital appreciation potential.

Defaults in Focus

Today, CEMBI has over 739 issuers from 59 countries with a market capitalization of $554 billion of which 60% are rated investment grade. If one were to canvass the universe of hard currency corporate bonds in emerging markets, as we often do here at MSIM, beyond the parameters of the benchmark and into frontier countries and quasi-sovereign issuers, the actual market capitalization would be closer to $2.6 trillion.

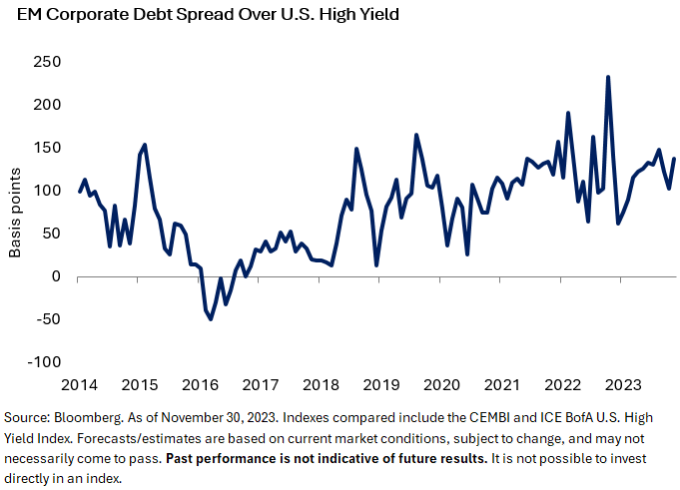

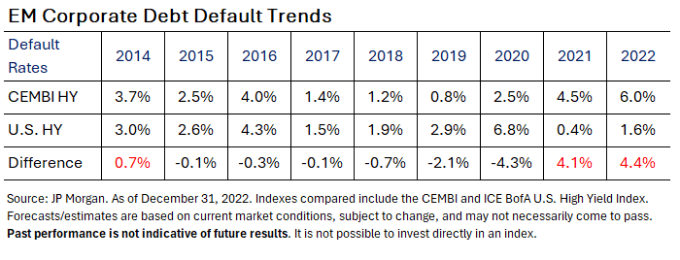

A recent study from JP Morgan shows that default rates among CEMBI high yield issuers has been lower compared to U.S. issuers while offering 75 basis points of additional spread.2

During the peak Covid year of 2020, CEMBI defaults were materially lower thanks to stronger balance sheets and access domestic funding channels, though there were isolated setbacks in 2021 and 2022 stemming from the China property slowdown and the war in Ukraine.

In March 2022, Russian corporate bonds were removed from the index to zero from a market weight of 4%. Excluding corporates tied to the Russian-Ukraine conflict and China property developers, defaults would have been 1.7% for 2021 and 1.8% for 2022.

While it is not uncommon for EM corporate defaults to be restructured in local courts, proceedings have typically followed a certain set of international norms to gain recognition in U.S. and UK courts (almost all EM corporate bonds are either governed by New York or UK law). It may surprise some, but average recoveries on defaulted EM corporate bonds have largely been in line with those in U.S. high yield.

Bottom line: The evolution of the asset class teaches an important lesson for investors: In our view, when active managers steer clear of isolated credit events, they can deliver attractive risk-adjusted returns in this asset class. Making decisions under the uncertainties of high interest rates, slowing economy, and geopolitical conflicts will certainly challenge the entire investment industry - but they can also create opportunities to express a differentiated view in the long-term. Even without the help of a crystal ball, we are indeed discovering one opportunity after another from our rigorous bottom-up credit selection and collaboration with our sovereign research team. We are very much looking forward to 2024. Please stay tuned.

JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified is an unmanaged index of USD-denominated emerging market corporate bonds.

JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified is an unmanaged index of USD-denominated bonds with maturities of more than one year issued by emerging markets governments.

ICE BofA U.S. High Yield Index is an unmanaged index of below-investment grade U.S. corporate bonds.

1 JPMorgan CEMBI launch in November 2007 through November 30, 2023.

2 JP Morgan Corporate Default Monitor. As of April 24, 2023.