Insights

Postcard from Ghana: The Cocoa Supply Chain Risk for Multinational Chocolate Producers

Featured

Postcard from Ghana: The Cocoa Supply Chain Risk for Multinational Chocolate Producers

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. We believe cocoa farmers must earn a living income to end child labor and deforestation.

2. Cocoa farmers are up against formidable forces along the supply chain and have little or no bargaining power on price.

3. Profit margins could be impacted if the price of cocoa soars, as farmers out opt out for other sources of income.

After a series of meetings with senior executives of several major chocolate producers, it was clear to us that we must go to Ghana to develop a deeper understanding of the challenges entrenched in the cocoa supply chain. We sought to reconcile the mixed messages we were hearing from these companies and to see first-hand how differing approaches were addressing the problem underlying the industry in West Africa: farmer poverty. The insights we gained from meeting with farmers, community leaders, trading companies, and government executives in November 2023 transformed our understanding of the supply chain and the limited success of the companies' initiatives to improve it so far.

Investing in companies with sustainable business models is at the core of our investment philosophy. Sustainable business models tend to produce sustainable financial performance, which we believe should lead to sustainable share price outperformance. These companies form the backbone of our endeavors to deliver an attractive return for our clients. These companies rely on secular sales growth, high profit margins, and strong return on invested capital to thrive. We aim to identify risks that might derail the sustainability of these business models and engage with management to understand how they mitigate these risks.

The cocoa supply chain and a living income

In our long-time engagement with relevant consumer companies, we found that the investment community is most concerned about child labor and deforestation. In recent years, however, we've become increasingly focused on low farmer incomes. To escape the vicious cycle, farmers must earn a living income, which is key to ending child labor and deforestation.

What is a living income?

A living income is the benchmark income level that enables people to enjoy a decent standard of living as stated in the United Nations' Article 25 of the Universal Declaration of Human Rights (UDHR). It is the net income a household must earn so that all members may afford a dignified and decent standard of living, including basic needs (food, water, housing, education, health care, transportation, clothing, other essential needs, and a provision for unexpected events).

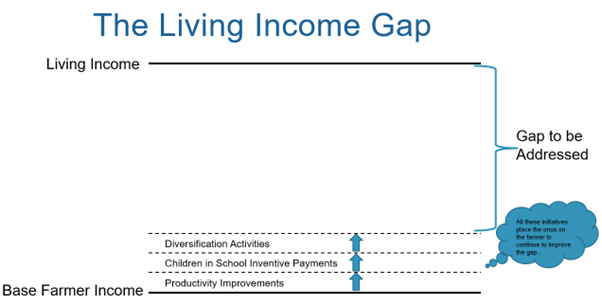

* Illustration of a typical program to lift farmer income in Ghana. Source: MSIM (Morgan Stanley Investment Management)

Ghana and Ivory Coast produce two thirds of all cocoa globally and problems appear more endemic in these countries. Ghana's government sets the price for cocoa. Cocoa farmers must sell their beans to licensed buying companies (e.g. commodity traders), which in turn sell them to the Cocoa Board, which sells all cocoa to chocolate manufacturers. The Cocoa Board reports to the Ministry of Finance, reflecting its importance within the country. This differentiates Ghana from other countries in West Africa and South America that operate more on a free market basis.

What we learned

Our time in Ghana was an educational and often humbling experience. The large multinationals have plans in place to improve equality, diversification of incomes, financial education, farm yields, traceability, and child labor. Unfortunately, we believe these initiatives can only partly close the living income gap. We met with women's groups, whose diversification into production of soap and cleaning products, enables them to help pay for their children's education and empowers them with a direct source of income.

We met cocoa farmers who have diversified into other crops to supplement income in the offseason. We also spent time with a best-in-class farmer and learned about the knowledge and techniques required to drive yields higher, even though he does not earn a living income. The entire process from planting to harvesting to drying is incredibly manual and takes many hands.

Parents focus on educating their children

Many parents acknowledged that their child at times skipped school to assist on the farm, because they could not afford to hire additional labor required to harvest cocoa. We spoke to a community where children were walking 1.2 miles each morning and evening to obtain household water from a stream. Even though some multinationals supply school clothes and books, children may still miss school due to the lack of basic water infrastructure. Poor road infrastructure in some communities isolates them in the rainy season.

We heard many stories about the rise in illegal mining, which is damaging land and drinking water. As the next generation shuns cocoa farming, there are fears this will only accelerate, further harming the environment and limiting the cocoa supply from Ghana.

Cocoa price is the fundamental problem

While multinational company programs may have clear benefits, they all put the onus on the farmer. The farmer must improve yields, diversify to other crops, and prove that their children are attending school, even though the price they are paid for their cocoa is too low to provide a decent living income. Farmers are increasingly abandoning cocoa and allowing mining on their land. Cocoa farmers are up against formidable forces along the supply chain and have little or no bargaining power. Ultimately, the price consumers pay for their chocolate should be higher than it is to humanely compensate farmers by providing a living income for farmers and their families.

The complexity of cocoa farmer poverty and why it matters

Farmers in Ghana face insurmountable challenges in their efforts to escape poverty. Market forces are not present. The small farms limit the necessary economies of scale. The ongoing depreciation of the Ghanaian Cedi embeds excessive systemic inflation. We question the efficiency of the Cocoa Board, whether the true intention of chocolate producers' programs is to boost their image more rather than raise the quality of life for farmers. It also remains to be seen if chocolate producers and investors are willing to accept lower margins on their products, and if consumers are willing to pay more for chocolate.

Steep risk to multinational companies and their profitability

Profit margins could be impacted if the price of cocoa soars because farmers opt for other sources of income and cause a decline in the global supply. Consumers may avoid particular brands if they are associated with impoverished farmers and their families.

The European Commission's proposed Corporate Sustainability Due Diligence Directive (CSDDD) puts the onus on companies to ensure compliance for all activities across the supply chain, including human rights and environmental breaches. It is imperative that companies manage this supply chain risk, rather than push it down the supply chain.

Conclusion

We will continue to prioritize cocoa farmer economics in our ongoing engagement activities with company executives. We believe that mitigating this risk requires real leadership and a different and more collaborative approach across companies.

1 Ivory Coast is Africa's largest producer of cocoa, followed by Ghana.

2 Source: Rainforest Alliance.